8 loyalty trends for 2026: AI hands power to the consumer

For the past 10 years, Currency Alliance has published a loyalty trends article which reflects a bit on what has been working to drive customer engagement.

We’ve also reflected on how market dynamics and technology will change the industry. But 2026 is the first year where we would argue the market itself is driving the biggest prevailing trend.

While most businesses experiment with AI, consumers are demonstrably already using the technology to shop around for better value. This is tilting all consumer markets, and not just the loyalty industry, further in the consumer’s favor.

Other than that, the major trends in the loyalty industry have not radically altered in the last year. We continue to see rapid, worldwide growth in the number of businesses using a points-based program to influence customers. This is in part because the cost of technology has come down so much in recent years, and most customers understand how points programs work – so they resonate.

We will continue to see a significant consolidation of loyalty currencies – in large part because customers cannot keep track of dozens of different loyalty points across the places they shop. For brands that have less frequent engagement with customers (fashion retail, big box retailers, and even travel brands, for the majority of customers), their proprietary points just don’t mount up fast enough so customers can earn interesting rewards.

And as loyalty ecosystems become larger and more complex, the utility of points as a unit of economic value between stakeholders is only going to increase.

But in 2026, the AI effect will accelerate all these trends and more. The AI-empowered consumer will be more light-footed and less patient than those of recent years, forcing brands to evolve their loyalty programs more quickly in the race for customer attention – and in some cases, survival.

Our trends for 2026 are as follows; you can click to jump to specific trends:

-

-

- AI-savvy consumers extract more loyalty value from brands

- Enterprise programs battle low switching costs for unsatisfied members

- Pioneering brands carve out clear leads in AI-driven marketing

- ‘Currency consolidation’ and accelerating multi-partner collaboration

- Cost management to deliver more value to customers

- Mobility and financial services brands break into the loyalty elite

- Emotional Loyalty: rewarding customers outside of transactional contexts

- The battle with loyalty fraudsters heats up.

-

1. AI-savvy consumers extract more loyalty value from brands

Every other ‘loyalty trends’ article is going to talk about how AI can help with personalization and member engagement. This trend is not about that, so pay close attention, because the implications of consumer empowerment will have tremendous impact on your loyalty program.

2025 was the year when AI search really took off, and consumers will increasingly call on AI agents to help them find the best value in the market.

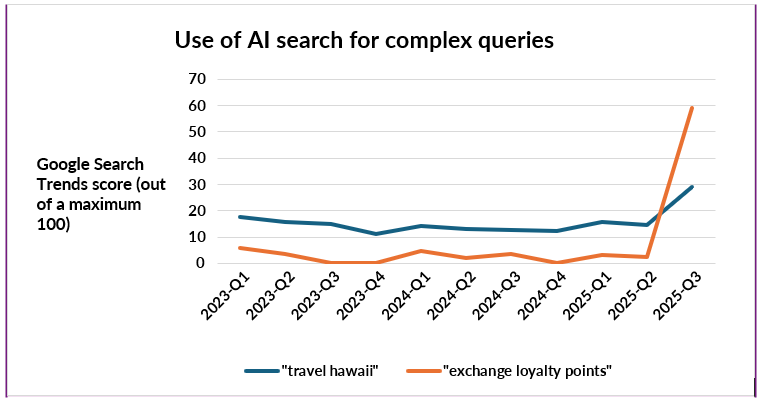

Illustratively: by the third quarter of 2025, there had been a large spike in people using AI search tools to figure out how to ‘exchange loyalty points’.

This data comes from Google Search Trends – which is heavily comprised of AI search activity as the AI bots trawl conventional search engines for information.

Some of the people searching this term would have been B2B loyalty professionals researching loyalty partnerships, but most of them would have been consumers figuring out what to do with their loyalty value.

As you can see here, some people are also using AI to search for ‘travel Hawaii’, but the change has been less drastic. It’s a relatively simple query, and the existing means for booking a flight and a hotel work quite well without AI.

This is just the beginning of an adoption curve.

Soon, we’ll see many customers enter their points balance and status in a loyalty program and ask the AI agent to optimize their trip for the best-value, covering accrual and redemption options.

This means that brands must now make their value as transparent and easily-discoverable as possible, so that the AI agents can surface the right options to the right customer.

Non-AI companies like Point.me (who might actually be using AI) have been providing such a human service for several years and gained the interest of major airline and hotel brands – because they can help create value for loyalty program members.

Loyalty programs have historically been less transparent than they might have been. The widespread disappearance of reward charts, in favor of dynamic pricing, has arguably tilted this further back in the brands’ favor.

We’re not arguing against dynamic pricing; indeed, allowing points/miles to take on dynamic ‘value’ depending on how they are spent will be the key in creating value for all stakeholders. But unnecessary opacity around the customer value will increasingly put companies at a competitive disadvantage.

AI search tools can rapidly process data from company websites, travel blogs and publicly available data such as weather forecasts. This means that customers will soon be able to get pretty accurate advice on where to get the best price for any given goods or services. Indeed, in October 2025 The Economist forecast ‘the end of the rip-off economy’, arguing that this democratisation of information will make it very difficult for businesses to charge anything above the fairest price.

If brands fail to make their value transparent in this way, there is a genuine risk (argue the authors of a study published on Hotel Dive) that customer loyalty could shift from the brands, to the AI tools themselves.

2. Enterprise programs battle lower switching costs for unsatisfied members

One consequence of better-informed customers is that switching costs are falling.

Switching costs comprise two calculations:

- the cost of leaving one brand, and any associated loss of points value or status

- and the payoff from joining another, with the time and effort needed to achieve rewards.

The ‘leaving cost’ is perceived as lower, because the most frequent members of many travel programs have enough points to ‘cash out’ and leave a small balance of points behind.

Leaving costs are a bit higher for members getting close to an attractive reward. But customers are increasingly aware, therefore, that their points could be devalued at any moment.

Airlines’ slowdown in member engagement, following points devaluations and limited supplies of reward inventory, has been widely discussed. (In fairness to the airlines, though, some of them have been successful in redistributing some reward value to less-frequent customers by offering more redemption options – which will likely pay off.)

Hotel groups, for a long time, have been beneficiaries of this trend, as they enabled more interesting rewards than airlines for an equivalent level of spending. But now, there are early signs that hotels’ loyalty growth may slow; in September, The Points Guy reported on a broad swath of apparent devaluations in hotel programs.

The payoff from joining another loyalty program, meanwhile, has increased for three main reasons.

One is that companies such as Uber, Revolut and others are now starting to build competitive value propositions. Read about Revolut’s loyalty strategy in our recent article on fintechs & payments startups; the payments company’s program seems designed to tempt customers away from popular credit card issuers.

The second reason is that travel brands now accept that, if they’re going to lose valuable customers more easily, it’s worth investing more in new member acquisition and retention. As a result, we’ve seen partnerships from brands which formerly regarded themselves as competitors, such as the recent tie-up between United Airlines and JetBlue, as a hedge against members leaving the brand entirely.

The third reason is that more brands now permit status-matching, whereby new customers can avoid the uphill climb to interesting benefits in a new program. The success of a company called Status Match shows how popular this has been with customers – and how popular brands are trying to poach attractive customers.

No loyalty programs really want to see their members chopping and changing loyalty programs like utility companies. To rebalance switching costs back in the brands’ favor, they need to do two things.

For one, they need to look further afield for customers: younger professionals, including in foreign markets, who are likely to be tomorrow’s high spending customers.

These cohorts are less concentrated than your typical business travellers and so they may seem harder to reach. But winning their loyalty while they’re young can open the potential for a lifelong relationship with high customer lifetime value (CLV). And as we explained in our recent article on hotel loyalty, brands can achieve this by partnering with local businesses in destinations, to greatly increase their brand reach at low direct cost.

The other is that more brands need to follow in the footsteps of United and Jet Blue, and partner more widely. This can avoid customer loyalty being an ‘all or nothing’ equation where customers might conclude the only route to good value is to ignore the loyalty program and buy services based on price and convenience only.

Quite how this plays out in 2026 may be affected by the global economy. If there is a stock market crash next year, travel brands could see demand fall, and it may become temporarily easier to achieve free flights and rooms, at least for customers able to continue traveling or spending on co-branded cards.

But the long-term trend is nonetheless towards lower switching costs, and brands being forced to work with less influence over customers than they had previously.

3. Pioneering brands carve out clear leads in AI-driven marketing

For about 10 years now, we’ve been advising companies to maintain a single source of truth on the customer, which all marketing teams can use to improve personalization.

What is absolutely clear, and made even more visible by AI experimentation, is that the quality of your customer data, and the ability for analytics systems to access that data, are of paramount importance. As the saying goes, ‘garbage in, garbage out’.

There’s much work to do here. As Tech Radar reports…

“…fragmented data is causing businesses huge issues, especially when it comes to AI.”

The same article quotes a HubSpot study which found that only 31% of companies believe their data is accessible to AI systems.

And so, we see most organizations still very focused on trying to get the right data into the necessary repositories, so that AI and other analytics platforms can work their magic.

Master data management (MDM) projects and customer data platform (CDP) implementations will accelerate in 2026. Depending on who you ask, the CDP industry is growing at between 21% and 40% CAGR.

So far, I don’t think customers are enjoying the benefits of this transformation work. I belong to 30+ loyalty programs and I do not sense any improvement in personalization. Granted: I’m a sample size of one, but my general impression is that the majority of loyalty programs are still not using AI beyond experiments.

It will be interesting to see case studies or conference presentations over the next year describing what has worked and what has not. But my guess is that a lot of the success stories will come from smaller, more agile businesses.

The Iconic (an Australian fashion brand) recently launched a new loyalty program whereby existing customers were granted automatic statuses reflecting their histories with the brand. This decision would likely have been based on a combination of purchase history and CRM data.

Hopefully The Iconic’s new loyalty software vendor has not forced them to adopt a new, parallel CRM. Keeping the data in order will only get more important, enabling brands to deploy AI-powered personalization with minimal friction – and likely leaving slower-moving enterprises with a lot of catching up to do.

4. ‘Currency consolidation’ and accelerating multi-partner collaboration

A primary reason that companies work with Currency Alliance is to enable common customers to earn points/miles across a larger ecosystem of partners, or exchange their points from one brand to another.

2025 has so far seen a 700% increase in new business enquiries, and through October, a 500%+ growth in transaction volume compared to 2024.

We had always predicted that the total number of currencies in the market would fall, as businesses sought to collaborate around popular currencies and accelerate customer frequency. Certainly, we are seeing more new loyalty programs being indifferent as to whether their customers earn their points, or those of a partnered brand.

Some of the enquiries we’re receiving are from earlier-stage businesses who are interested in allowing customers to move their points value around, as part of their go-to-market strategies. Examples of these include AD Capital Markets, Klarna, PayRewards and others.

But there is growing recognition that true currency consolidation is inevitable in the near future. Evert de Boer, a loyalty thought leader, recently commented on the Wall Street Journal that “the writing is on the wall” for this to happen, as “there are far too many players pursuing the same thing.”

We have also seen the Spenn loyalty coalition evolving, with the Retain retail group joining the existing travel brands.

Spenn is intended to resolve the perceived friction around points and miles exchange from one brand to another, by simply operating a unified currency between different brands in the Nordics.

The truth is that with modern technology, earning, redeeming, or exchanging among different loyalty currencies can also be seamless. We can see this from examples like Club Avolta, which allows customers to earn many popular loyalty currencies.

The point is, this is a step towards currency consolidation, however it’s enabled. In 2026, we expect to see more brands making the ability to earn other brands’ points as a leading part of their value proposition.

5. Cost management to deliver more value to customers

Adopting modern technology remains one of the best ways to drive down the operating cost of a loyalty program; that is widely-known.

Most brands could probably make savings on many other operating costs. We’d recommend that every team list the top 25-30 costs in their business every year and seek to actively implement savings where ROI on those efforts will be greatest.

This year we expect to see cost-savings trends in the following areas.

Partnership optimization

As loyalty partnerships accelerate, we will see a wave of companies looking at how to make their partner networks more capital-efficient.

One key area for consideration here is the cost of points and miles exchange.

When a customer transfers points from one brand to another, one brand in the partnership incurs an expense; the other generates some incremental margin from selling additional points to the partner.

This looks like a happy scenario for the profiting brand, but the overall effect is that money, that otherwise would be spent on incentives, is leaving the ecosystem. If the transaction processing fees are high, this ultimately devalues customer loyalty for all stakeholders.

Some brands are spending millions of dollars a month on such exchange fees – and as partnership networks expand, the bills only get larger.

Loyalty teams, therefore, and their colleagues in the procurement and financial departments, are now rightly questioning how to bring down those costs.

In practice, the cost of processing a points transaction between brands can be almost nothing. Currency Alliance charges 2% to process such transactions, and our clients can eliminate a lot of operational costs, since all the reconciliation and settlement on those transactions can be automated.

It’s up to brands to decide what margin they add on those exchanges, and how much impact the cost will have on volume. But there is no longer any ‘good’ reason for such partnerships to be expensive to maintain, beyond whatever value is deemed reasonable between collaborating brands.

Proprietary redemption catalogs replace third-party options

Last year we predicted a rise in rewards at lower price-points, as brands court the infrequent customer, including the use of vouchers and gift cards.

The natural next step is for brands to cease the need for third-party redemption catalogs, when they can easily convene redemption options on their own.

In the finserv sector, for example, traditional banks mostly still rely on aggregated content from third parties. By contrast, neobanks such as Monzo, N26 and others appear to host individually-negotiated partner offers in proprietary rewards environments.

The use of proprietary redemption catalogs will accelerate. Ecommerce technology is now so low-cost and easy to use, it’s harder to make a business case for a third-party supplier.

Meanwhile, enterprises will rapidly broaden their partner networks, with SMEs as redemption and accrual partners, thanks to dramatically lower costs of partner onboarding and collaboration.

Of course, every single redemption is an opportunity to collect valuable customer insights – all the more reason to ensure that this customer activity takes place within your own ecosystem.

6. Mobility and financial services brands break into the loyalty elite

Mobility and finserv loyalty programs have been ascendent for a few years, but in 2025, the sheer number (and high quality) of new or expanded loyalty propositions from these brands should be watched closely by the whole loyalty industry.

For about 30 years now, the dominant brands in loyalty have been travel brands and credit card issuers. Grocery has come a close third. These brands had clearly defined roles in the ecosystem:

- travel brands – for aspirational redemptions (and accrual for frequent flyers)

- credit card issuers – accrual for the majority of consumers who spend across a wide portfolio of merchants and tend to aspire to redeem for travel

- grocery & convenience-store – further accrual opportunities because of frequency (though a lot of grocery points end up being spent back in the store)

Really, though, the promise of luxury travel was what really motivated customers to participate and made the ecosystems function.

The success of credit card issuers like Amex and Chase, in turn, had been because of their everyday utility. A rewards credit card is a highly effective accrual mechanic in high interchange fee countries, and this made the brands synonymous with low effort, every day earning opportunities.

Two sectors are likely to take a chunk of these brands’ market share over the next year and beyond.

The first includes fintech ‘startups’ (many of which are quite mature companies). These brands tend to focus on a niche, but high-volume financial service by providing more specialized solutions than Amex or Chase. Many such fintechs are now producing compelling loyalty propositions, which some customers will see as their best way to earn towards their next trip.

These scaling firms, arguably, are freer to scale their loyalty programs because they are not shackled, cognitively or financially, to funding points issuance through interchange fees – which are now far too low in many parts of the world to fund interesting rewards.

In practice, points can be funded however brands choose. This can include by:

- charging product fees, as does Revolut, and many premium credit cards

- getting merchant partners to fund points issuance. Most merchants already pay for cashback schemes, affiliate marketing fees, discounts or for search traffic – so they will see paying for 1% to 5% of the purchase amount in points as an attractive, cost-effective alternative

- simply allocating marketing budget – this means that incentives can go up even when trade falls and the loyalty program can be leveraged to reinvigorate customer spending

- selling more complementary products like insurance, where margins can be whatever the customer is willing to pay

- selling points to partners and investing the money back into points issuance.

The dependence on interchange fees was always somewhat artificial, and it could well end up costing market share to established finservs in many markets, unless they evolve.

The other is mobility. Uber is the clear leader here with a very well-developed partner network comprising air and rail travel. As the ride-hailing business connects more journeys from door to door, the accrual opportunities during a given trip may double for people who use a lot of different transport options domestically and abroad (i.e., commuters and business travellers).

Unsurprisingly, then, these ascendant fintech and mobility firms are now a lot more interesting to the airlines and hotel groups as accrual partners. These companies can also unlock an entire new trove of customer data and help with customer acquisition in destination markets.

2026 might be too early, but within a few years, one or two brands in this space might deliver a globally dominant loyalty program that rivals some of the biggest today. Their frequency of engagement with customers, and digital-first natures, mean they are well-placed to create a compelling super-app as the entry point for payments and mobility. An example of a super app that delivers value beyond its core business, as the one entry point for solving many customer challenges, is the AirAsia Big SuperApp in ASEAN.

7. Emotional Loyalty: rewarding customers outside of transactional contexts

Emotional loyalty is a longstanding loyalty trend, which will inevitably remain prominent for a number of reasons.

For one: a better grasp of customer data, and the use of modern marketing technology, make it a lot more practical to introduce analytics and incentives at many more touchpoints.

Secondly, you can no longer afford to wait for someone to make a transaction in order to incentivize loyalty – because the customer may never convert unless you establish the relationship during the product search stage.

Loyalty marketing agency TLC Worldwide has published case studies on its work with brands including Starbucks, Sephora Beauty Insider and American Family Insurance, which reward customers for things like:

- sending gift cards

- trying new products

- participating in surveys

- writing product reviews

- attending events

- engaging with the brand on social media.

- and (in the case of the insurance brand), watching safety videos and more.

These tactics are now widespread among SMEs, so emotional loyalty is probably more of a trend for the decade rather than specifically in 2026. In any case, with lower switching costs, if you are only rewarding purchases, you’re probably underinvesting in crucial emotional attachment to the brand.

Yet these tactics are largely still missing from enterprise programs in credit cards, travel, and retail.

That’s probably because they’re seeing such great transaction volumes from spending-based rewards that they might see emotional loyalty as a distraction. But I imagine we’ll see greater uses of emotional loyalty by such companies in the coming year, as it’s now arguably become a competitive standard for a modern loyalty program.

8. The battle with loyalty fraudsters heats up

Imagine if one in every 12 or 13 shoppers in your store were robbed. Customers would stop coming in.

And yet, that’s the current state of play with loyalty programs, according to one recent paper by Arkose Labs, a cybersecurity vendor. Their study found that 8% of loyalty program members had fallen victim to an account takeover (ATO), and this is largely concentrated in the travel industry – where companies without bank-grade security hold billions of dollars of currency value.

That’s a huge increase in ATOs since their previous survey in 2018, when only 3% of respondents had suffered an attack. The study was on a fairly small sample size of 133 respondents, but it’s certainly a widespread trend.

The cybercrime problem is not exclusively the fault of the loyalty program operators; the researchers cite recycled customer passwords as a persistent weak point (though permitting these is a choice made the loyalty program).

The major concern now is the massive increase in the use of AI-powered fraud software by criminals. “Corporate systems are under constant attack”, say the authors, citing conversations with various enterprise loyalty programs.

This is a huge and growing problem for loyalty programs. If the customer loses their points, do you refund them to retain the member? – or tell the customer it is their fault and possibly lose their repeat business?

In addition to ATO attacks, one common weak point to be addressed, in light of the acceleration in partnerships, is the large number of partner integrations via APIs. Each one of these integrations is a possible point of entry for sophisticated and automated digital attacks, creating dozens or even hundreds of points at which the ecosystem can be breached. This effectively means that not only the brand’s own technology, but potentially also every one of its partners, are potential security risks.

We are experiencing a significant consolidation of API integrations as brands request that partners connect via secure third parties – rather than integrate directly. This is a core part of Currency Alliance’s role as a marketplace enabler for loyalty partnerships.

Whether or not your brand works with Currency Alliance, the absolute minimum should be to:

- adopt cybersecurity software

- demand strong passwords from members

- periodically confirm customers’ identities

- and introduce multi-factor authentication for sign-ins and irregular or large transactions.

These things are the bare minimum in financial services but concerningly lacking in many areas of the loyalty industry. They help to explain the disparity in how often these different types of businesses are hacked.

Don’t follow the loyalty trends; follow customer value

As we look back at our predictions over the past decade, it feels like we were 100% correct in calling out the “fads” that were hyped-up and would likely pass.

We were about 80% correct in predicting the fundamental improvements that each brand needs to execute efficiently, at scale, to achieve their business objectives.

Relying on loyalty marketing to achieve desired business outcomes takes many years, during which each step can take you closer to your goals. It is not a few projects where a brand just jumps in and sees amazing results.

Since each organization with a loyalty program will be at different stages in that journey, not every new technology or market evolution will have the same impact across stakeholders. That includes AI, which seems like it may soon benefit smaller more agile businesses around personalization, but may cost larger enterprises around margins, fraud, or customer retention, unless they rapidly evolve.

So, as we have said in nearly all prior trends articles, each business needs to objectively understand their strengths, weaknesses and opportunities in order to adopt the right strategy and tactics.

We hope this trends article helps you align your own priorities for the coming years. The trends don’t apply to all businesses equally, but together, they should make clear the necessary evolution in the industry, and the need for all brands to constantly innovate and collaborate around improving customer value.