Loyalty collection mechanics: identifying members at the POS

Recognizing loyalty program members at the Point of Sale (POS) has been challenging for over 30 years. Large brands with their own loyalty program typically invest heavily to integrate the loyalty platform into one or more POSs, but for smaller and medium-sized companies, this is often out of reach in terms of cost and technical complexity.

The result is that it can be difficult for a retailer to deliver a smooth customer experience when identifying their own loyalty program members, or customers in partner loyalty programs, at the POS.

This topic has also been in the spotlight recently, with retailers asking customers to log into an app to take advantage of the best loyalty offers – with some debate over how this affects the customer experience.

The earliest collection mechanic put the burden on customers by using a stamp card, stamp book or collecting copper nickels – and the brand had no idea who was holding those tokens of loyalty. Today, however, loyalty program members can be identified when making purchases by various means, which have been evolving over the years, and this is accelerating as mobile technology matures.

Widely-used collection mechanics that depend on integrating into the POS include:

- scanning a membership card, barcode or QR code at the POS

- entering a personal identifier (i.e. phone number or tax ID) into the POS

Methods for identifying the member transaction after the purchase include:

- giving the customer a receipt which they can photograph with their loyalty app after their transaction or simply send a picture to a web destination

- card linking and open-banking – whereby the customer’s bank or credit card provider shares data with the retailer.

There are also more modern approaches involving mobile wallets, NFC/Bluetooth readers, and hardware modifications to the POS. These are all described in more detail below.

The purpose of this article is to explain the various options, and to help brands choose the most effective method for their business. At the end, we will also discuss the Universal Points Terminal, which serves as a workaround for businesses which want to recognize the program member at the time of purchase, but cannot affordably integrate their POS with their loyalty platform.

This article focuses on brick-and-mortar retail stores – because that is where identifying the customer is most technically challenging.

But this article is also relevant to the operators of large coalition loyalty programs, as well as in travel and banking, since retailers are valuable loyalty partners of these brands. This is thanks to the quality of data they yield on the customer, and the ability for these partners to enable everyday earn or burn to drive frequent customer engagement. Retailers in your partner network may welcome a conversation around their collection mechanics to make loyalty marketing more productive in your loyalty ecosystem.

Retailers should prioritize real-time loyalty engagement in-store

In a single retail store, you may find hardware and software from several vendors. But across the industry in general, there are thousands of suppliers that provide POS systems, payment terminals, scanners, receipt printers, etc.

This means there is no single, optimal way to identify the customer at the POS. But there are 4 priorities that should determine the optimal approach for a given retail store.

- Identifying the customer at the point of sale – since this maximizes the opportunity for in-store engagement and data collection

You can’t do much follow up marketing if all the customer has done is turn in their completed stamp card.

The richest data will come from identifying the customer in real-time at the POS, capturing the contents of their shopping basket, and allowing them to engage with offers in-store. Many customers won’t make much effort at the POS, however – so the requirement for this interaction should be balanced with the customer’s time and patience for engaging with promotions.

- Cost & ease of management – both for setup, and ongoing administration

Customers can be immediately identified at the point of sale through scanning loyalty cards or a QR code, if the POS backend is integrated with the loyalty platform. As explained, however, integrating multiple POS systems could be unaffordable for many businesses. That may mean the business collects loyalty scans at its various POS systems, and then relies on batch processing to update the customer profile later on.

The important thing for a retail organization operating at scale is to automate as much of this process as possible, since this lowers operating costs and shortens the time between the transaction and further loyalty engagement. That is easier if the data captured is in digital format in the first place.

- Customer effort – will the customer consider the work of engaging your collection mechanic to be worth the reward?

In theory, some collection mechanics can be zero effort to the customer, like card linking (full explanation below), but that comes at a higher operating cost to the brand.

On the other hand, engaging with your brand’s app, swiping a plastic card or scanning a QR code may have little or no ongoing cost – but slows the customer down at checkout, or sometimes they simply forget. Another factor is that most customers are only willing to carry 1-3 additional cards in their wallet – so depending on the importance of your brand, or your loyalty program to the customer, you may or may not be one of those few cards they are willing to carry.

- Speed at checkout – can you process these loyalty interactions without slowing the customer down at the POS?

If you operate a high-volume retail environment – like a grocery store – you cannot add 10 seconds to the checkout process by requiring non-essential steps for the customer to identify themselves. It has to be fast.

Fortunately, for the majority of retailers in moderately-paced environments, adding a few seconds to the customer identification process is acceptable to the customer, and does not usually frustrate other customers waiting in line.

Generally, the ideal collection mechanics are those which identify the customer at the point of transaction, and allow loyalty engagement during the transaction. This is the lowest-effort for the customer, and maximizes in-store engagement, increasing the collection of useful data for the brand.

Understanding the different loyalty collection mechanics

To put these choices into context, consider this real-world example.

We are currently working with a global retail organization with over 5,000 locations in over 65 countries. Many of these business units have been acquired over the past 15 years – and they now have 8 different POS systems installed.

Now, consider the different collection mechanics available to this business.

Mechanics which (potentially) allow the customer to be identified in real time

| Mechanic | Description | |

| 1 | A plastic membership card | …with a unique membership number, and possibly a magnetic strip or bar code that can be understood by the POS |

| 2 | The member’s phone number or national ID number | typically entered into the POS |

| 3 | A bar code or QR code in a mobile app | usually scanned by the POS scanner |

While the first three options rely on the customer identifying themselves, they score well for low customer effort. They’re also a highly affordable way to allow customers to earn points at your checkouts, since nearly all POS terminals can scan barcodes and/or QR codes. Those codes could be on a mobile app, a keyring, printed on a plastic card, or in the body of a personalized email.

Real-time customer identification would require integrations between the loyalty platform and any POS systems in use. That could then allow discounts can be applied at the checkout, or a receipt could be printed with special offers based on the customer profile.

The alternative is matching transactions to the loyalty member’s profile via batch processing – which would incur greater ongoing internal costs. The 5,000-location retailer in our example would be managing a great deal of data across a large member-base, so both upfront and operating costs need to be considered to make sure all this activity generates a positive return on investment (ROI).

The brand must also minimize delays in processing because the customer experience would suffer if points are issued weeks after a purchase.

An evolution on these methods would be biometric methods such as fingerprint scans, facial recognition, or similar – if the customer trusts the brand to store such personally-identifying data. I am unaware of this having been deployed at scale, but it will become feasible over the rest of this decade. This is arguably a faster and simpler way for the customer to identify themselves at checkout, but it introduces challenges if the loyalty program allows accounts for a family, as many grocery programs would do.

Mechanics which enable digital engagement at POS

| 4 | Spot transactions via a mobile wallet | Since the mobile payment wallet is digital, it can send data to almost any other system in the technical architecture |

| 5 | Near-field Communications (NFC), RFID, or Bluetooth technology | This functionality could be embedded in the app for a loyalty program and used to synchronize data with some form of reader at the POS – but these implementations are still rare |

| 6 | ePOS integration with digital interactivity | A brand with cloud-based POS software integrates the backend directly with their loyalty platform, allowing the customer or retail professional to interact with the loyalty program on-screen |

The key benefit of all these approaches is potentially allowing the customer to engage more proactively with the loyalty program at the POS, improving both the customer experience and the collection of data.

Working with mobile wallets – Apple Wallet, Alipay, PayPal, Curve, etc. – is a very interesting and fairly new approach that can deliver an excellent experience for customers. Since customers are spending using their mobile wallets anyway, this makes it a zero-effort solution for the end-user; they simply need to add your loyalty card to their wallet of choice. This allows points transactions to take place regardless of the POS, but it requires that your company interface to the mobile wallet – which has its own challenges.

If too many mobile wallets are widely used in your market, then coordinating with all of the providers can be a challenge for the loyalty program.

One way to get around this is for the loyalty program operator to integrate mobile wallet functionality in its own app, so the customer can make payments with it. In this way, the brand controls all the transactions within their own environment – and potentially even enables the customer to engage before the transaction (i.e., to select certain offers, or paying with points). A brand which has achieved this is the UK’s Tesco supermarket, which operates a widely-used loyalty program, and stores payment cards for use within the app.

Of course, customers might only download such an app from brands with which they make regular purchases, so if your customers only shop a few times per quarter, most are unlikely to keep it installed.

For options 5 and 6: ePOS integration to the loyalty platform has already been discussed – and integrating NFC/RFID/Bluetooth technology with various POS systems might also be difficult for retailers, including the one in our example.

Indeed, the retailer in our example took option 6: integrating their loyalty platform with their 8 different POS systems, via the Currency Alliance API. This means that all customers, in all countries, can now engage in loyalty offers in-store – but this was only-cost effective due to the brand’s scale.

Mechanics where the customers are identified after the transaction

| 7 | Receipt scanning | The customer takes a picture of the transaction receipt and submits it to an email address or website – which will convert the printed information into digital information using Optical Character Recognition (OCR) software. Once this is in digital format, any number of actions can be taken to incentivize the customer. |

| 8 | Open Banking in Europe and some other regions of the world | Enable transactions to be identified in the customer’s current accounts or payment card accounts after the transaction was completed, and incentives can be provided at a later date. |

| 9 | Payment card linking | Rely on the payment network to inform you when a registered card number is used at one of your locations – basically matching the 16-digit card number with the payment network’s merchant ID. |

Option 7 (submitting a picture of the receipt) is not that much more effort, and it does allow the brand to engage the customer with further offers and incentives – but only after the transaction. There will inevitably be leakage as customers forget or deprioritize loyalty engagement once they leave the store.

Options 8 and 9 both depend on your loyalty program collaborating with a fintech partner – but many customers may not consent to their accounts being connected due to security concerns.

Open banking does open up the opportunity for digital engagement after the transaction, but only applies in certain markets, and so it wouldn’t be a complete solution for a brand present in 65 countries. In fact, you might need different fintech partners in each country because very few operate on a global basis.

Card-linking improves on open banking in the sense that Visa and Mastercard – and American Express, to a lesser extent – are widely used in many markets (though not Germany, France, and other important countries). Card-linking has been gaining traction over the past decade – and is basically the technology used by any incentives program that is providing cashback as well.

With card-linking, the loyalty program member registers a payment card with the loyalty program. When that card is used at a participating partner location, the payment network (or a third-party accessing the payment data) isolates each matching transaction and reports it to the loyalty platform. This means the customer can be identified regardless of the POS technology, and points are then issued based on the nature of the payment transaction.

One downside to this is that it can be relatively expensive. For example, the cost to spot card-linked transactions is often between 6 and 10 US cents and can cost $50,000 to $75,000 to set up the program with each of Visa, Mastercard, American Express, or other payment networks. If the customer is earning 30 cents to 50 cents worth of points for a new purchase, the cost can make up 20%+/- of the amount the brand is willing to offer the customer as an incentive.

Alternatively, you can avoid the setup cost and get this service from third parties who have already integrated into the major card scheme networks. They will charge a fee per transaction processed, however – so every approach to card linking inevitably diminishes the value that can be delivered to the customer.

Another downside is that the customer may spend on a different card. Importantly, though, when the customer does use the linked payment card, the retailer also loses all opportunity for digital engagement in an environment that they control, because the identification of the customer typically takes place with the fintech company, hours later.

*

There are workarounds to some of the limitations in the collection mechanics described above.

A somewhat expensive solution, but very effective in a high-volume environment, would be to install hardware and software between the POS and the receipt printer. Such a device intercepts the data about the purchase and can be linked to a specific customer to capture the transaction details – effectively bringing the benefit of cloud connectivity to a legacy POS terminal. This hardware/software might cost about $400 per POS, but if you are processing 100 transactions per day at each POS, the cost per month per transaction is just pennies.

And, Currency Alliance offers a Universal Points Terminal which enables in-store digital engagement and real-time, automatic points transactions at the POS, without the need for integration. See below.

It is worth mentioning that these are not mutually exclusive options; for instance, a brand may generally rely on card-linking, but could also use the Universal Points Terminal to increase in-store engagement.

In the UK, Sainsbury’s Nectar program gives the option of card-linking, but you can also get better value in-store by scanning a QR code.

And certainly many hotel groups, that use card linking and open-banking based offers, also operate conventional loyalty cards which can be scanned for purchases at branded locations.

With all this variability in the retail environment, there is no one solution that can fit the business needs of all retailers. Each business with a loyalty program or any business that wants to incentivize customers with the points of other loyalty programs, therefore, needs to figure out what can work best for its objectives and for its customers.

People’s knee-jerk reaction is that to streamline the process and create an elegant customer experience, “We need to integrate”. That decision is often quickly discarded, however, following the cost analysis – since vendor POS and payment terminal systems are typically not very open to such integrations.

Brands are advised, therefore, to investigate all the different collection mechanics that may seem relevant, in order to find the optimal setup – possibly including a hybrid solution.

The Universal Point Terminal: enabling collections across the partner network

Many SME retailers, with less than 50 locations, have some variation in POS equipment. These businesses often want to run loyalty marketing initiatives – whether independently, or by offering the points or miles of a larger partner brand.

Currency Alliance designed the Universal Points Terminal with this use-case in mind. It’s an app that can be run in any browser on any device, which could include the POS itself, or a tablet, mobile phone, laptop, etc. It integrates with the loyalty platform typically for free – in days, or even hours.

This allows loyalty transactions to take place at any point of sale, without integrating the POS to the loyalty platform.

This is highly useful to retailers with heterogenous POS systems – and also, therefore, to loyalty coalition operators who wish to increase their network of collaborating partners across a wide range of different retail categories – thereby improving customer engagement. The customer becomes able to easily interact with the loyalty program at checkout, with almost zero additional direct cost to the retailer, or the loyalty program operator. A good case study on this comes from Currency Alliance’s work with Air Miles Middle East.

Air Miles is the brand of several coalition loyalty programs operating in different parts of the world by different owners. In the Middle East, Air Miles covers countries like Egypt, Bahrain, Qatar, Oman and the United Arab Emirates. In this coalition, Air Miles works with dozens of local merchants and regional retail chains.

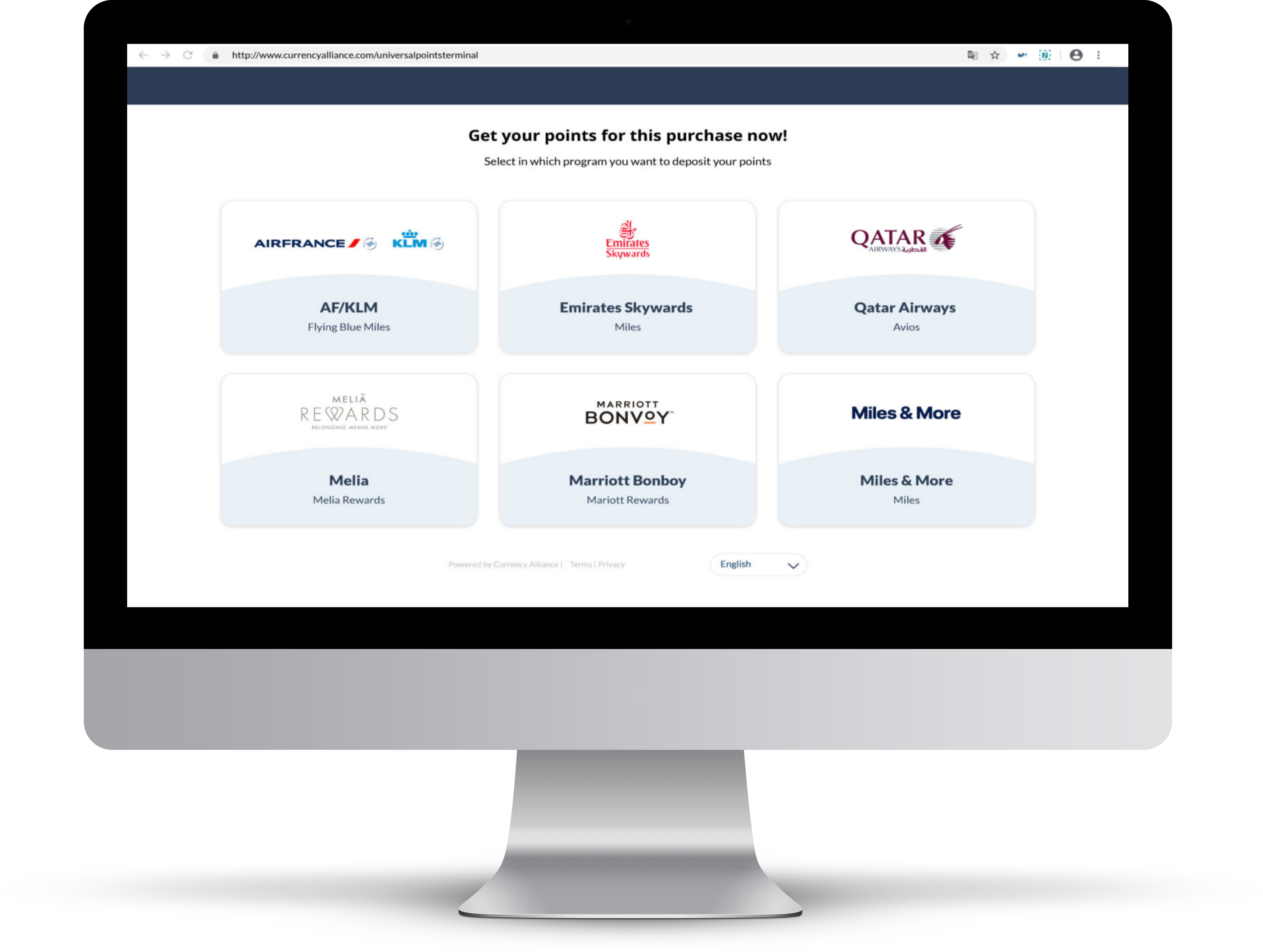

For these partnerships to work, Air Miles must provide each coalition partner with efficient technology to identify the Air Miles member, calculate how many points to issue and enable redemptions.

Air Miles cannot dictate the POS hardware or software that their partner retailers use in-store – since they each have their own standards and business needs. These retailers use the Universal Points Terminal webapp, which can adapt to any browser, on any device, without the need to integrate to the POS.

In order to identify the customer, the retail clerk can simply type in the member’s identification number – or, the Universal Points Terminal software can scan a QR code in the Air Miles app.

Within seconds, the Universal Points Terminal calculates the level of incentive based on the transaction value and the member’s profile, and then credits new points to the member’s loyalty account for purchases.

Similarly, the Universal Points Terminal can be configured to allow customers to pay with points at the retail partner – with account authentication via a one-time passcode sent to the member’s phone or email.

Finally, the webapp can also be used to register new members and accept vouchers, and supports all the administrative and reporting tasks associated with the retailer’s participation in the coalition loyalty program.

*

Other use-cases for such a setup would be any commercial center or shopping mall which has a few, or hundreds of retail tenants.

In such cases, the commercial center operator (usually the landlord) has almost zero influence over which POS solution each retailer uses. Therefore, if they want to run a shopping center-wide loyalty program, they need to capture member transaction data across a very heterogenous environment. That means the only viable solution is for the common software to run in a general-purpose browser, ‘over the top’ of the POS and payment terminal solutions installed by each participant.

This is even relevant within a single company that might operate 300 convenience stores, or even for a franchise operation like Dunkin’ Donuts – since the central company may have various generations of POS or payment terminal solutions installed across their locations.

In the examples so far, we have implied that the brand deploying a solution to identify customers will be issuing its own loyalty points. However some customers (especially less-frequent customers) who would never get to interesting rewards in the majority of loyalty programs, might prefer the points/miles from another loyalty program – such as an airline or hotel group.

The Universal Points Terminal can also enable customers to make that choice at the point of purchase, in a matter of seconds, as long as you’re partnered with the relevant loyalty programs.

Granted, you would have to pay your partner for their points issued to common customers, but that cost will be tiny compared to the value of the additional data you collect on a broader set of customers, who otherwise would not join your loyalty program unless they could earn their preferred points/miles.

And, that cost will almost certainly be less than what you would pay in cashback, affiliate marketing fees, discounts, or Google search costs to acquire or retain the same customers, while also earning the opportunity for continued marketing directly to the customer.

Enabling customer choice & freedom around loyalty redemptions

Given the wide variety of hardware and software installed among retail locations, there is no silver bullet that solves all challenges in a cost-effective way. The more homogenous your technical environment is, the more options you have to deploy a solution with economies of scale.

Therefore, I like to think about the options by evaluating them by a type of decision-tree. If you have 50+ locations and the POS is the same, an integration to scan QR codes, bar codes, or other identifiers that the customer carries with them becomes viable. With this approach, the customer experience will be consistent – without the dependency on third parties for ongoing services.

If you have a heterogeneous retail environment and the average transaction value is over $75, then card-linking can be cost-effective. And, if you have fewer than 50 locations and some variation in POS equipment, then the Universal Points Terminal is probably your best option.

Generally, evidence is demonstrating that loyalty marketing is far more cost-effective than other means of customer acquisition or retention so smaller companies will enter the loyalty game – albeit, perhaps not by creating their own loyalty program, but rather leveraging those from partners.

Rapidly declining costs for loyalty technology means that businesses of almost any size can now compete on a more level playing field with the heavyweights in their industry. That includes at the point of sale – where innovation is enabling retailers to earn customer loyalty more efficiently, in a way that creates more value both for customers, and for partnered brands in their loyalty ecosystems.